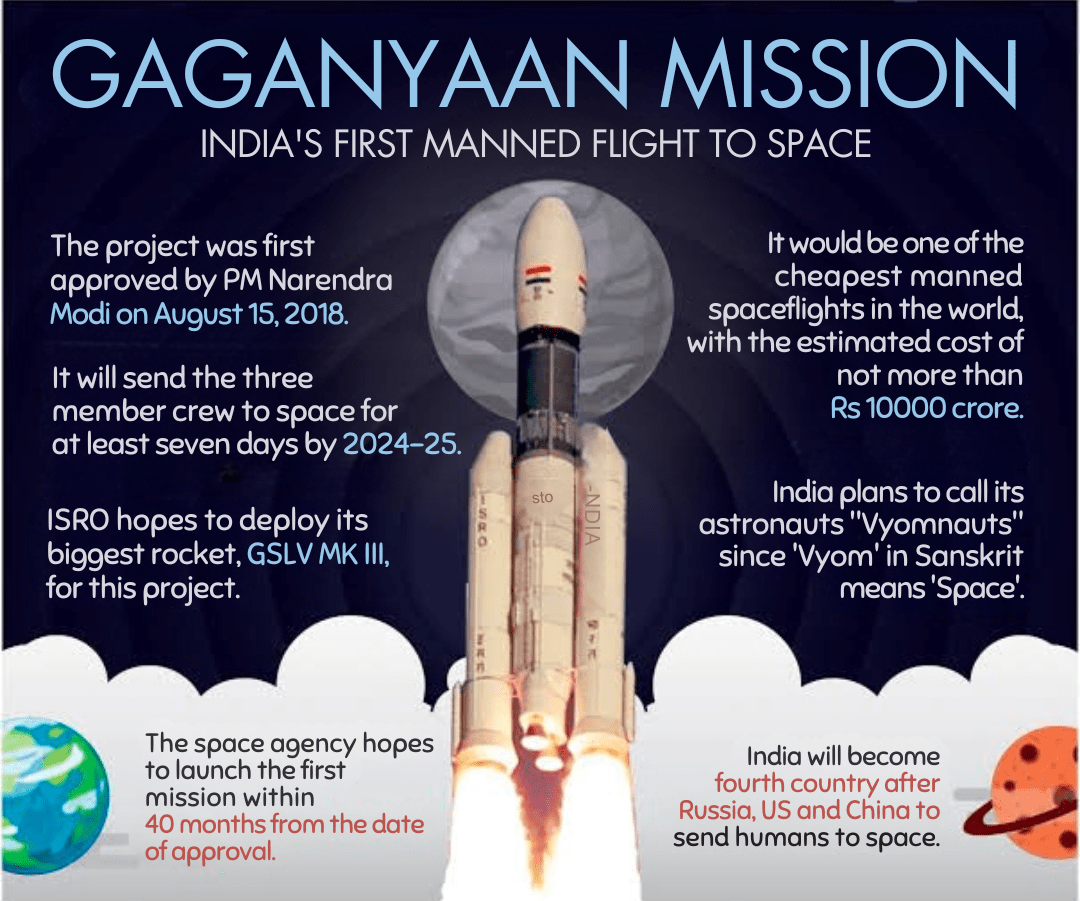

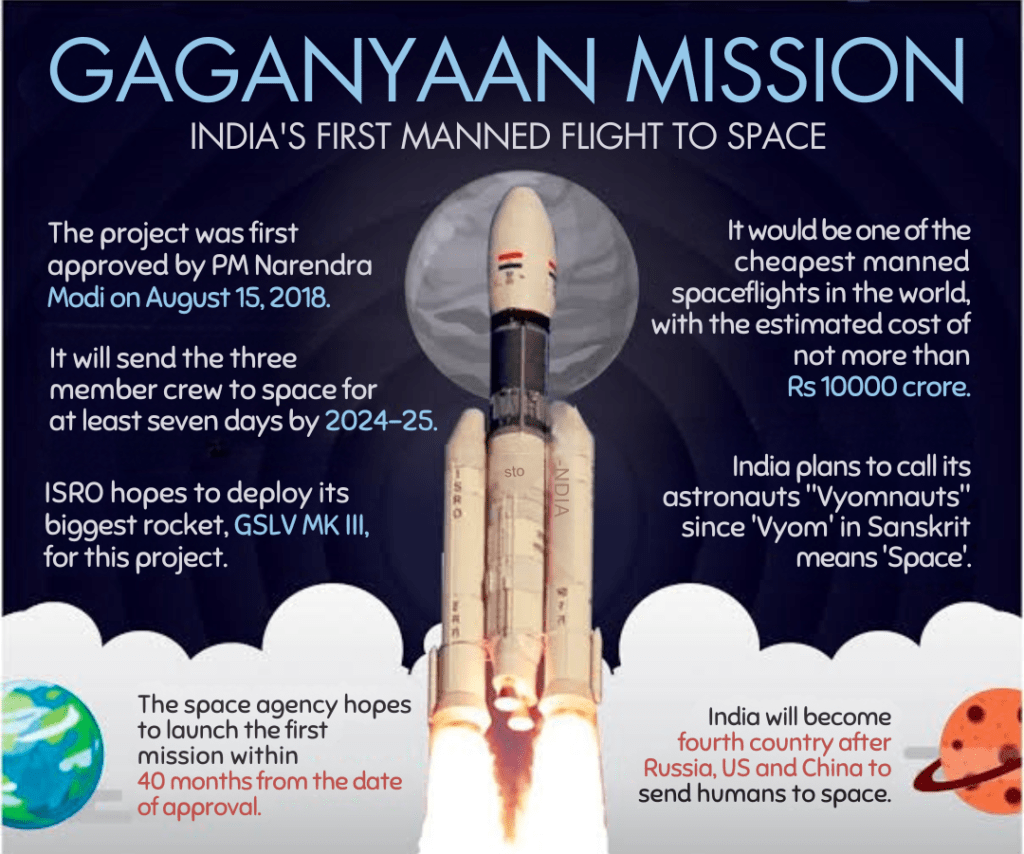

2.Gaganyaan Mission(ISRO):

In news:

● India has selected two ‘Gaganyatris’ for NASA’s Axiom-4 mission to the

International Space Station.

About Gaganyaan Mission:

1.Space-borne Assistant and Knowledge Hub for Crew Interaction (SAKHI) App:

● Developed by: Vikram Sarabhai Space Centre (VSSC), ISRO, located in

Thumba, Thiruvananthapuram.

● Purpose: A multifunctional app designed to support astronauts on the

Gaganyaan mission with tasks such as accessing technical information and

facilitating communication.

● Features: Monitors astronaut health, ensures connectivity with Earth, and

manages dietary schedules.

Vyommitra:

● Developed by: ISRO Inertial Systems Unit, Thiruvananthapuram.

● Design: Half-humanoid with a torso but no legs.

● Purpose: Simulates human functions for space missions before real astronauts

launch.

● Features: Resembles a human with facial expressions, speech, and sight.

● Digital Twin: Will undergo computer simulations to test control systems in

microgravity conditions

● Vyommitra will be part of the first unmanned test flight before the crewed

Gaganyaan mission, expected in 2024.

● It will simulate human functions in space.

● It will test whether the systems are functioning correctly.

Gaganyaan Mission:

● Objective: India’s project to send a 3-day manned mission to Low Earth Orbit

(LEO) at 400 km with a crew of 3 and return them safely to Earth.

● Approval: Includes two unmanned missions and one manned mission, approved

by the Government of India.

● Timeline: First manned spaceflight expected in 2024.

● Significance: Success will place India among elite nations (US, Russia, China)

with human spaceflight capabilities.

Objectives:

● Immediate Aim: Demonstrate indigenous capability for human space flights.

● Long-Term Goal: Establish a foundation for a sustained Indian human space

exploration program.

Privilege Motion:

In news: The Congress has filed a privilege motion in the Rajya Sabha against

Home Minister Amit Shah, accusing him of misleading the House about the

Wayanad landslides.

About Privilege Motion:

● Parliamentary Privilege:

○ Refers to the rights and immunities of Parliament and MPs necessary for

performing their functions as per the Constitution.

○ Defined by Parliament under Article 105 of the Constitution, but no specific

law has been enacted; governed by British Parliamentary conventions.

● Breach of Privilege:

○ Occurs when there is a violation of the privileges of MPs or Parliament.

○ Includes actions like casting reflections on MPs, Parliament, or its

committees.

● Privilege Motion:

○ A motion moved by any member of either House alleging a breach of

privilege.

○ Must meet two conditions:

- The matter should be recent.

- The matter requires intervention by the Council.

● Procedure:

○ The Speaker of the Lok Sabha or Chairman of the Rajya Sabha is the first

to review the privilege motion.

○ They can either decide on it themselves or refer it to the Privileges

Committee of Parliament.

○ The Privileges Committee, consisting of ten members and a Chairman

appointed by the Rajya Sabha Chairman, examines the motion.

○ If the Speaker/Chairperson approves under Rule 222, the member

concerned is allowed to make a brief statement.

4.INFLATION(Context, Definition, Types, How

Calculated, Causes, Effects, Solution etc.)

Context:

● Food inflation remains a major concern, even as core inflation hits a record

low at 3.1%.

● In June, food inflation spiked, raising the Consumer Price Index (CPI)

inflation to 5.1%, up from 4.8% in May, primarily driven by increasing prices

of vegetables, cereals, milk, and fruits.

● Despite a favorable base effect, food inflation climbed to 9.4%, with

vegetable inflation soaring to 29.3%.

● TOP inflation soared to 48.4%, driven by onion prices at 58.5% and

potatoes at 57.6%. However, tomato inflation eased to 26.4%, down from

41.3%.

● Non-TOP vegetables experienced a rise in inflation, increasing to 19.7%

from 18.8%.

● Rural inflation increased to 9.2% from 8.6%, while urban inflation was more

stable, rising by 20 basis points to 8.8%.

INFLATION:

About:

● Inflation refers to the rise in prices of common goods and services, such as food,

clothing, and housing. It is measured as the average change in the price of a

basket of goods over time and indicates a decrease in the purchasing power of a

country’s currency.

For example:

Currently, 1 liter of milk costs Rs. 50, up from Rs. 40 a year ago.

This represents an increase of Rs. 10, meaning Rs. 40 now only buys 800 ml of milk.

Using the formula ((50−40)/40)×100=25((50-40)/40) \times 100 =

25((50−40)/40)×100=25,

we can conclude that milk prices have inflated by 25% compared to last year.

Types:

● Monetary Inflation

Monetary inflation occurs when excessive money is printed by the RBI.

● Open Inflation

Open inflation refers to a situation where prices rise without any

government-imposed price controls.

● Suppressed/Repressed Inflation

Suppressed or repressed inflation happens when the government enforces price

controls and rationing during crises, like wars or pandemics. Once these

measures are lifted, prices surge.

● Headline Inflation

Headline inflation measures total inflation in an economy, typically represented

by the Consumer Price Index (CPI) or Wholesale Price Index (WPI).

● Structural Inflation

Structural inflation is inherent to a specific economic system, requiring a

complete policy overhaul to eliminate it.

● Creeping Inflation

Creeping inflation refers to a low inflation rate (up to 4%) that is considered safe

and beneficial for job creation and economic growth.

● Walking/Trotting Inflation

Walking or trotting inflation occurs when the inflation rate is moderate, ranging

from 4% to 9%.

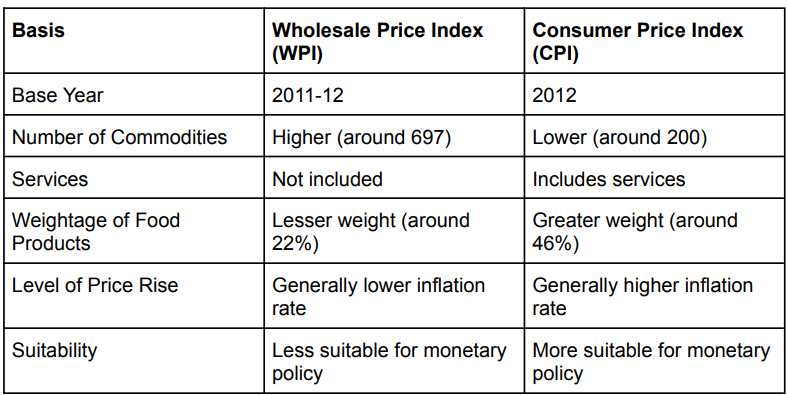

How inflation calculated

In India, inflation is primarily measured by:

● Wholesale Price Index (WPI): Calculated monthly by the Ministry of Commerce

& Industry.

● Consumer Price Index (CPI): Determined by averaging price changes for items

in a predetermined basket of goods.

● Producer Price Index: Measures average changes in selling prices received by

domestic producers over time.

● Commodity Price Indices: A fixed-weight index of selected commodity prices,

based on either spot or futures prices.

● Core Price Index: Tracks consumer prices excluding volatile food and energy

prices, indicating underlying inflation trends.

● GDP Deflator: Measures general price inflation in the economy.

Causes:

1.Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand increases due to factors such as:

● Fiscal stimulus

● Population growth

● Higher net exports

● Monetary stimulus

● Policy decisions

2.Cost-Push Inflation

Cost-push inflation arises from rising production costs, which can be caused by:

● Increases in employee salaries

● Rising raw material prices

● Higher profit margins for firms

● Increased import prices

Effects of Inflation:

● Redistribution of Income and Wealth

Inflation redistributes income and wealth, benefiting some groups while

disadvantaged others.

● Borrowers vs. Lenders

Borrowers gain while lenders lose. For instance, if a debtor borrows Rs. 100 at a

5% interest rate, they repay Rs. 105. If inflation exceeds 5%, the real value of the

repayment declines.

● Producers vs. Consumers

Consumers face reduced purchasing power and must pay more for goods and

services, benefiting producers while harming consumers.

● Flexible Income vs. Fixed Income Groups

Flexible income groups, like self-employed individuals, adjust to inflation and

remain unaffected, whereas fixed-income groups, such as daily wage earners,

suffer as their purchasing power diminishes.

● Debenture Holders vs. Issuers

Bond issuers benefit while bondholders lose, as fixed bond rates often fail to

keep up with inflation.

● Equity Holders Income

Equity holders benefit from higher profits during inflation, leading to increased

income.

Solutions:

- Monetary Policy: The Reserve Bank of India (RBI) controls inflation through

monetary policy by adjusting key interest rates, such as the repo rate, to

influence money supply and credit. The RBI also conducts Open Market

Operations (OMO) by buying or selling government securities, impacting the

money supply and inflation. - Fiscal Policy Measures: The government manages inflation through fiscal

policies like taxation and public spending. Higher taxes can reduce disposable

income, curbing demand and inflationary pressures. - Food Price Management: To address rising food prices, the government

implements schemes like the Minimum Support Price (MSP) and the Public

Distribution System (PDS) to manage supplies and prices. - Buffer Stock Operations: The government maintains buffer stocks of essential

commodities to stabilize prices during shortages, which helps mitigate inflationary

pressures. - Exchange Rate Management: The government oversees and manages the

exchange rate to maintain competitiveness in international trade. A stable

exchange rate helps control import costs, contributing to price stability.

Comparison of WPI and CPI

Related Concepts

- Deflation : Deflation is a persistent decline in the general price level, essentially

the opposite of inflation, characterized by a negative rate of change in the price

index. - Disinflation : Disinflation occurs when inflation rises at a slower rate. For

instance, if inflation was 6% last month and dropped to 5% this month, it is

termed disinflation. - Reflation : Reflation is a government strategy to intentionally increase inflation to

stimulate the economy, typically implemented to counteract deflationary

conditions.

Comparison between Core and Headline Inflation:

| CORE Inflation | HEADLINE Inflation |

| Core inflation measures the persistent increase in the general price level of goods and services, excluding volatile items like food and energy. By focusing on stable prices, it provides a clearer long-term trend in inflation, aiding in the formulation of long-term policies. | Headline inflation encompasses the total inflation in an economy, including all goods and services purchased by consumers. It reflects the overall rate of price change over time. In the RBI’s Flexible Inflation Targeting (FIT) framework, the CPI (Combined) is used to measure headline inflation. |

Phillips Curve

● The Phillips Curve illustrates the inverse relationship between unemployment

and inflation, indicating that as unemployment decreases, inflation tends to

increase, and vice versa. Named after economist A.W. Phillips, who introduced

this theory in 1958.

Stagflation and Phillips Curve

● Stagflation, a combination of stagnation and inflation, describes an economic

situation where low economic growth coincides with rising prices.

● Typically, higher inflation is associated with robust economic growth, making

stagflation a rare phenomenon and an exception to the Phillips Curve.

Way forward:

● Amidst inflation worries, collaboration between the government and RBI is

crucial. Actions might include stabilizing food prices, enhancing supply chain

efficiency and adopting a prudent monetary policy.

Inflationary effects are unevenly distributed across the economy. Unexpected

inflation can harm the economy by increasing market volatility and complicating

long-term budgeting for businesses. Conversely, moderate inflation can be

beneficial, fostering job creation and economic growth.

5.Governor should be a bridge between Centre and

State

In news:

● On August 2, Prime Minister Narendra Modi urged Governors to effectively

bridge the Centre and State governments.

● He addressed a two-day Conference of Governors, inaugurated by President

Droupadi Murmu, hosted at Rashtrapati Bhavan.

● The Prime Minister emphasized that the Governor’s role is crucial for the welfare

of people within the constitutional framework, especially in tribal areas.

About Governor :

Appointment:

● The President of India appoints the Governor of a State by warrant for a five-year

term.

● The Governor is not elected by the public or a special electoral college.

Qualifications:

● Must be an Indian citizen.

● At least 35 years old.

● Conventionally, the Governor should be an outsider who does not reside in the

state where appointed.

● The President must consult with the state’s Chief Minister when appointing a

Governor.

Constitutional Position:

● Article 153: Requires the appointment of a Governor for each state. The 7th

Amendment allows one person to be Governor of multiple states.

● Article 154: Grants the Governor executive power over the state, to be exercised

directly or through subordinate officers, in accordance with the Constitution.

● Article 163: Establishes a council of ministers, led by the Chief Minister, to assist

and advise the Governor, except when the Governor acts at his discretion.

● Article 164: States that the council of ministers is collectively responsible to the

state’s legislative assembly, forming the basis of the state’s parliamentary

system.

Powers:

● The Governor has similar Executive, Legislative, Financial, and Judicial

authorities as the President of India.

● However, the Governor’s powers are limited compared to the President, lacking

military, diplomatic, and emergency authorities.