1.Private Member Bill:

Context:

A private member’s bill has been introduced in the Rajya Sabha to safeguard

workers’ rights in the context of artificial intelligence.

More Facts about Private Member Bill:

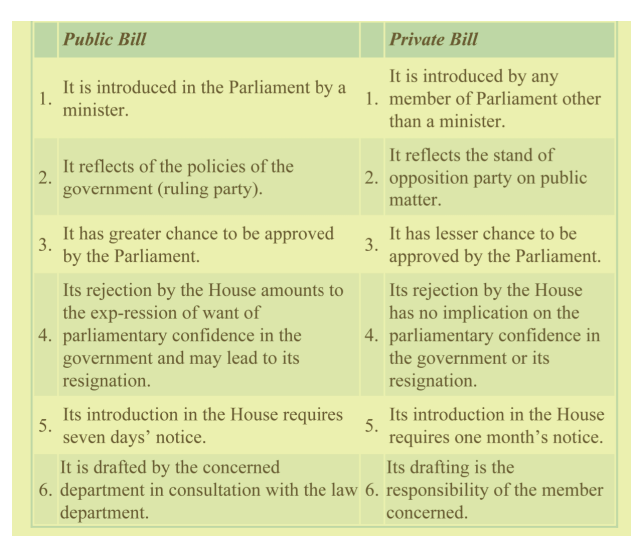

Introduction: Members of Parliament (MPs) from both the ruling and opposition parties

can introduce Private Member’s Bills.

Passage: For a Private Member’s Bill to become law, it must be approved by both

houses of Parliament.

Presidential Assent: After passing both houses, the bill requires the President’s assent

to become an Act.

Scheduling: These bills can generally be introduced and discussed only on Fridays,

reflecting their secondary priority compared to government business.

Limit: The number of Private Member’s Bills that can be introduced is capped at three

per parliamentary session.

Since 1952, only 14 Private Member’s Bills have become laws. In the 14th Lok

Sabha, of over 300 Private Member’s Bills introduced, only about 4% were

discussed, with the remaining 96% lapsing without debate

2.“Game Changing” Weight Loss Drug ‘Tirzepatide’:

The emergence of different weight loss medications has significantly transformed

obesity treatment recently, particularly in the US and Europe. However, these

drugs are not yet available in India due to pending regulatory approvals and high

demand overseas, which has delayed their entry into the Indian market.

However, this situation may soon change. Last week, an expert committee from

India’s drug regulator approved the drug tirzepatide for the first time.

In 2017, the US Food and Drug Administration (FDA) approved Novo Nordisk’s

Ozempic, containing the active ingredient semaglutide, for managing type 2

diabetes. Shortly thereafter, doctors in the US noticed an intriguing side effect:

weight loss.

The FDA has approved Wegovy (semaglutide) and Zepbound (tirzepatide) for

chronic weight management in adults.

● These medications can be prescribed to individuals who are obese (with a

body mass index over 30) or overweight (with a BMI between 27 and 30)

and have at least one associated health condition, such as high blood

pressure, high cholesterol, or type 2 diabetes.

Side Effects:

● The company reports that the most common side effects of Zepbound

include nausea, diarrhoea, vomiting, constipation, abdominal pain,

indigestion, injection-site reactions, fatigue, allergic reactions, belching,

hair loss, and heartburn.

3.Zika Virus:

Context:

● The Zika virus is making the news once again.

About Zika virus:

● The Zika Virus is mainly transmitted by female Aedes aegypti mosquitoes,

active during the day, also known for spreading Dengue fever. Other Aedes

species implicated in Zika transmission include Aedes Africanus, Aedes Furcifer,

Aedes Hensilli, Aedes Vittatus, and Aedes Luteocephalus.

Treatment:

● Currently, there is no specific treatment for Zika Virus. Medical care aims to

alleviate symptoms and manage complications as they arise.

● Similarly, there is no vaccine available yet; prevention efforts center on

protecting against mosquito bites, removing breeding sites, and implementing

public health measures to control mosquito populations.

Infection during pregnancy can lead to congenital malformations, including

microcephaly and related conditions.

Microcephaly: Microcephaly is a birth defect characterized by babies being born with an

abnormally small head and underdeveloped brain.

Other causes:

● In addition to mosquito bites, Zika virus can be transmitted through sexual

intercourse, blood transfusions, and from mother to fetus during pregnancy or

childbirth.

Origin:

● The Zika virus was first identified in monkeys in the Zika Forest of Uganda in

1947.

Government scheme regarding zika virus:

● One of the Indian government schemes related to Zika virus is the National

Vector Borne Disease Control Programme (NVBDCP). This program includes

measures for surveillance, prevention, and control of vector-borne diseases

such as Zika, Dengue, and Chikungunya.

4.Finance Commission:

Context:

● The sixteenth Finance Commission, chaired by former Niti Aayog

Vice-Chairman Arvind Panagariya, has started its work by seeking public

input on its mandate set by the Centre. Formed in December last year, the

commission, comprising five members, aims to submit recommendations

by October 2025, effective from April 1, 2026, for a five-year term.

What is Finance Commission?

● The Finance Commission in India is indeed a significant constitutional body. It is

established under Article 280 of the Constitution of India and serves a crucial role

in the fiscal federalism of the country.

● Its main function is to recommend the distribution of financial resources between

the Union Government and the State Governments, thereby ensuring equitable

distribution and fiscal stability across different levels of governance.

● The Finance Commission is not a permanent body and is constituted every five

years, or at times as deemed necessary by the President of India.

● This periodic formation allows it to reassess and recommend adjustments based

on evolving economic circumstances and developmental needs.

Composition:

● The Finance Commission comprises a Chairman and four members appointed

by the President, serving at the President’s discretion with eligibility for

reappointment

Qualifications:

● Accordingly, the Parliament enacted the Finance Commission Act of 1951, which

outlines the qualifications for members of the Finance Commission as follows:

● The Chairman must have experience in Public Affairs, and

● the four other members must be chosen from individuals with expertise in fields

such as

judiciary,

government finance and accounts,

financial administration, or

economics

Functions:

The Finance Commission of India recommends on:

- Tax revenue distribution between the Centre and States, and among States.

- Principles for Central grants-in-aid to States from the Consolidated Fund.

- Methods to enhance State Consolidated Funds for local bodies, per State

Finance Commission suggestions. - Any other financial matters referred by the President for fiscal stability.

Recommendations of the Finance Commission cover:

Recommendations of the Finance Commission cover:

Vertical Devolution pertains to the share of States in the central tax pool, enhancing

fiscal autonomy.

Horizontal Distribution involves allocating resources among States based on a

formula for equitable fund distribution, fostering balanced regional development.

Grants-in-aid are additional transfers to states or sectors needing assistance or reform,

like enhancing judicial systems or statistical infrastructure, promoting inclusive growth

and addressing regional disparities.